Our Location Enables Our Unique Service

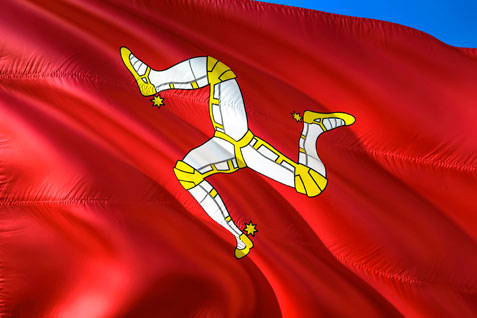

The Isle of Man is in a unique position as the only offshore international business centre that enables registration for EU VAT/IVA, yet still permits businesses to benefit from a zero direct tax regime.

The Isle of Man is in a unique position as the only offshore international business centre that enables registration for EU VAT/IVA, yet still permits businesses to benefit from a zero direct tax regime.

Working closely with a select leader in tax and VAT advisory services, our seamless financial management solution includes the option to import the aircraft into the European Union via the Isle of Man, including:

Requesting an Economic Operation Registration and Identification (EORI) number

Obtaining evidence of VAT paid status (C88A)

Use of VAT deferment account, in conjunction with the VAT offset arrangement allowed by Isle of Man Customs & Excise; to avoid the requirement to make a physical payment of import VAT

IOM.AERO enjoys a close working relationship with the Isle of Man’s Aircraft Registry and Civil Aviation Administration, ensuring a seamless registration process and helping owners to realise the full benefits of the M-Register. Some of the advantages of the M-Register include: